All Categories

Featured

In 2020, an estimated 13.6 million united state families are accredited capitalists. These homes manage massive wealth, approximated at over $73 trillion, which stands for over 76% of all private wide range in the U.S. These financiers take part in investment chances normally inaccessible to non-accredited capitalists, such as investments in exclusive firms and offerings by specific hedge funds, personal equity funds, and financial backing funds, which permit them to grow their wide range.

Review on for information regarding the most current recognized investor alterations. Financial institutions normally money the majority, yet hardly ever all, of the capital required of any kind of procurement.

There are mostly two policies that permit providers of safeties to use unrestricted quantities of safety and securities to financiers. llc accredited investor. Among them is Policy 506(b) of Law D, which enables a company to sell protections to limitless certified financiers and approximately 35 Advanced Investors only if the offering is NOT made via basic solicitation and basic marketing

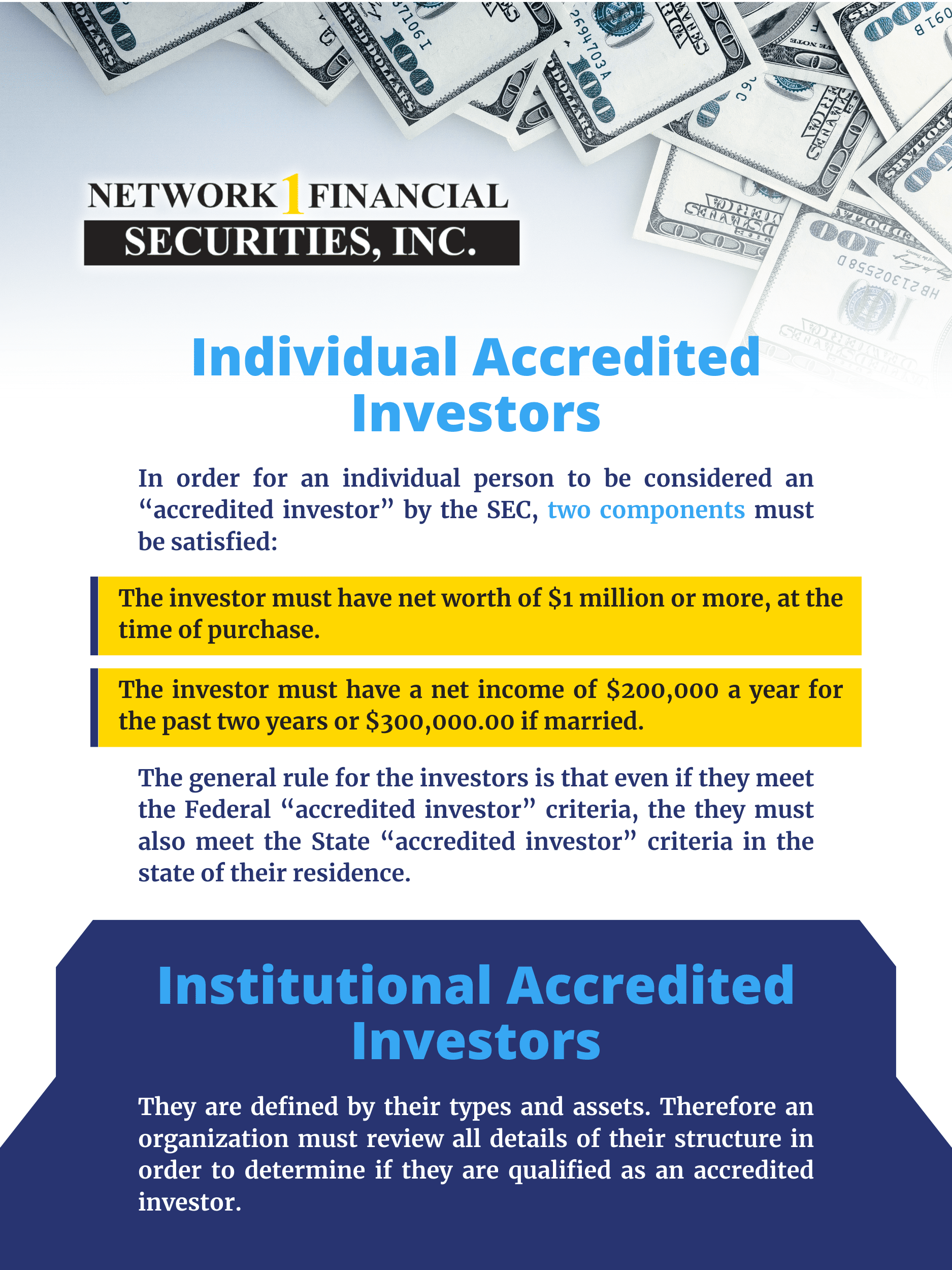

The recently taken on amendments for the first time accredit individual investors based on economic elegance requirements. The amendments to the accredited capitalist definition in Regulation 501(a): consist of as certified capitalists any kind of trust fund, with overall assets much more than $5 million, not created particularly to buy the subject securities, whose acquisition is guided by an innovative individual, or consist of as accredited capitalists any kind of entity in which all the equity proprietors are certified capitalists.

There are a number of enrollment exceptions that eventually increase the universe of prospective financiers. Numerous exceptions need that the financial investment offering be made just to individuals that are certified investors (sec regulation d accredited investor).

Furthermore, accredited investors often receive a lot more favorable terms and greater possible returns than what is readily available to the general public. This is because private positionings and hedge funds are not called for to adhere to the exact same regulative demands as public offerings, enabling even more versatility in terms of financial investment approaches and possible returns.

Accredited Investors

One factor these safety and security offerings are limited to accredited financiers is to ensure that all getting involved capitalists are monetarily advanced and able to take care of themselves or maintain the risk of loss, therefore providing unnecessary the defenses that come from a registered offering. Unlike safety offerings registered with the SEC in which particular details is called for to be disclosed, business and private funds, such as a hedge fund - accredited investor test or financial backing fund, participating in these excluded offerings do not have to make recommended disclosures to accredited investors.

The web worth test is reasonably basic. Either you have a million bucks, or you do not. On the revenue test, the person must please the thresholds for the three years regularly either alone or with a spouse, and can not, for example, please one year based on individual earnings and the next 2 years based on joint revenue with a partner.

Latest Posts

Foreclosure Property Tax Liability

Tax Liens New York

Paying Someone Else's Delinquent Property Taxes