All Categories

Featured

Table of Contents

These alternative investment platforms permit you to explore genuine estate, start-ups, and technology options. By utilizing these platforms, new financiers can discover numerous kinds of financial investment choices while acquiring real-life experience. Bear in mind to greatly veterinarian the firms before investing as crowdfunding is not greatly regulated and is riskier than conventional financial investment sources.

All investments are threats but with the ideal support, you can have more self-confidence in your decisions. Diversification and Threat Management- by expanding your portfolio you likewise diversify your threat. Not all financial investments have the same timelines, benefits, or dangers. This is the most effective way to develop an investment foundation and develop long-lasting wide range.

Due diligence is the very best way to comprehend the investment, the enroller, and the danger variables. If an enroller isn't happy to review danger, reward, and timelines, that is a warning. Successful Non-Accredited Financier Participation- Some firms use the ability to spend along with them such as This business permits retail investors to get passive revenue by using their platform to spend through an equity REIT.

Who provides reliable Real Estate Investment Partnerships For Accredited Investors options?

Sponsors have set guidelines on disclosures and paperwork readily available to non-accredited investors. Crowdfunding is open to all capitalists yet non-accredited are managed on investment amounts based upon income. Exception 506 B- enables approximately 35 innovative unaccredited capitalists to participate together with recognized financiers. There are necessary monetary statements that need to be submitted.

To stay certified they have to comply with policies regulating private positionings discovered in. Compliance Requirements for Syndicators- Forbids syndicate recommendation settlements for any person aside from SEC-registered brokers Non-accredited investors obtain additional disclosures Enrollers need to supply using files Financier Defense Procedures- The regulations secure investors from fraudulence and guarantee that publicly traded firms supply precise financial details.

Attaching realty crowdfunding systems can be an eye-catching choice to buying residential or commercial property the conventional means. It allows you merge your money with other capitalists to enter on deals you could not access otherwisesometimes for as low as $10 (Accredited Investor Real Estate Crowdfunding). It also makes expanding your property profile across several homes easy

Capitalists take advantage of residential or commercial property appreciation, recognized at the end of the holding duration, and routine rental earnings, distributed quarterly. Similar to many realty, Got here considers its residential properties lasting investments. Holding periods are typically 5-7 years for long-lasting services and 5-15 for trip rentals. The platform doesn't permit individuals to leave their investments prior to the holding period is over.

Approved and non-accredited financiers can after that buy shares of properties for just $100. The business aims for 12- to 24-month lasting leases and makes use of significant scheduling websites like Airbnb and VRBO for temporary services. To earn money, Showed up includes an one-time sourcing charge in the share rate (3.5% of the residential property acquisition rate for long-lasting leasings and 5% for getaway services).

Is High-return Real Estate Deals For Accredited Investors worth it for accredited investors?

In addition, some buildings are leveraged with a mortgage (usually 60-70%), while others are purchased with money. All home mortgages are non-recourse, suggesting capitalists aren't accountable for the financial debt and do not require to certify for debt. Each building is housed in a Series LLC to protect investors against personal obligation and the off chance that Showed up ever goes out of service.

You can also access your account through an Apple application (presently, there's no Android application, but the business plans to launch one in 2024). The business site has a chatbot for asking Frequently asked questions and sending messages, which it commonly responds to within a day. The website likewise details a support email address however no telephone number.

Who offers flexible Residential Real Estate For Accredited Investors options?

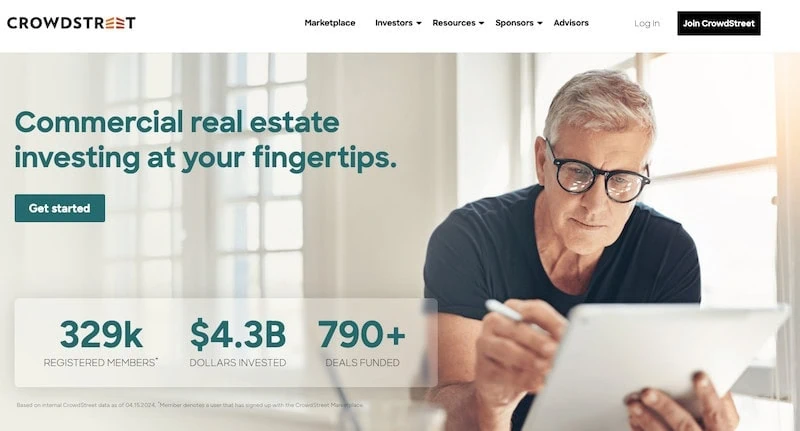

With the exception of a exclusive REIT, the business does not fund its very own bargains. Rather, it lets property sponsors put on have their offers vetted and listed on the system. As soon as moneyed, investments are after that taken care of by the original enroller. CrowdStreet supplies all sorts of business realty investments: multifamily, retail, office, clinical structure, self-storage, industrial, and land chances.

According to the firm, equity financiers normally earn quarterly dividends as a share of profits, while financial debt investors gain quarterly returns at an agreed-upon rate of interest. Nevertheless, distributions aren't guaranteed, and sometimes returns aren't recognized till the property markets. There is practically no option to retrieve your capital or exit your financial investment prior to the hold duration finishes.

Crowdstreet fees property sponsors charges for using the system. Those charges lower capitalist distributions. Furthermore, enrollers additionally take costs as component of the offer, which can vary by deal, but normally consist of a purchase cost and administration cost, to name a few. Each financial investment's fee framework is divulged on the website, and users can log in to track their financial investment's efficiency.

Compared to various other systems, CrowdStreet has a high barrier to entrance. It's just offered to accredited capitalists, and the minimal financial investment for the majority of deals (including the personal REIT) is $25,000. Users can make deals, track their investment performance, and interact directly with sponsors with an on-line website, yet no mobile app.

Where can I find affordable Private Real Estate Deals For Accredited Investors opportunities?

The company website has a chatbot for asking FAQs or sending out messages as well as a call email address. According to the firm internet site, as of 20 October 2023, CrowdStreet creators have invested $4.2 billion throughout over 798 offers, of which 168 have been understood.

It detailed its first fractionalized home deal online in 2012. Since after that, the firm has actually relocated to a private REIT model. Individuals can select between financial investment plans that favor lasting recognition, additional earnings, or a mix of both.

We suggest Fundrise if you desire an absolutely easy investing experience. Choose a financial investment plan that fits your objectives, established auto-investing, and you're ready. RealtyMogul is an on the internet industry for industrial realty bargains. Nevertheless, it likewise provides two private REITs: one that focuses on creating month-to-month rewards for capitalists and another that targets lasting capital recognition.

Depending upon the deal, investors can typically expect holding durations of 3 to 7 years. Leaving your investment prior to completion of the hold duration or re-selling it isn't feasible. For cash-flowing buildings, quarterly circulations prevail yet not ensured. RealtyMogul charges actual estate sponsors charges for utilizing the system.

DiversyFund is a more recent property crowdfunding system that released in 2016. It possesses and takes care of REITs that include one or more multifamily residential properties. Some are offered to non-accredited capitalists for a $500 minimum investment, while others are only available to recognized investors and have minimum financial investments of approximately $50,000.

Latest Posts

Foreclosure Property Tax Liability

Tax Liens New York

Paying Someone Else's Delinquent Property Taxes